2H20 Mortgage Lender Outlook

FREE EBOOK

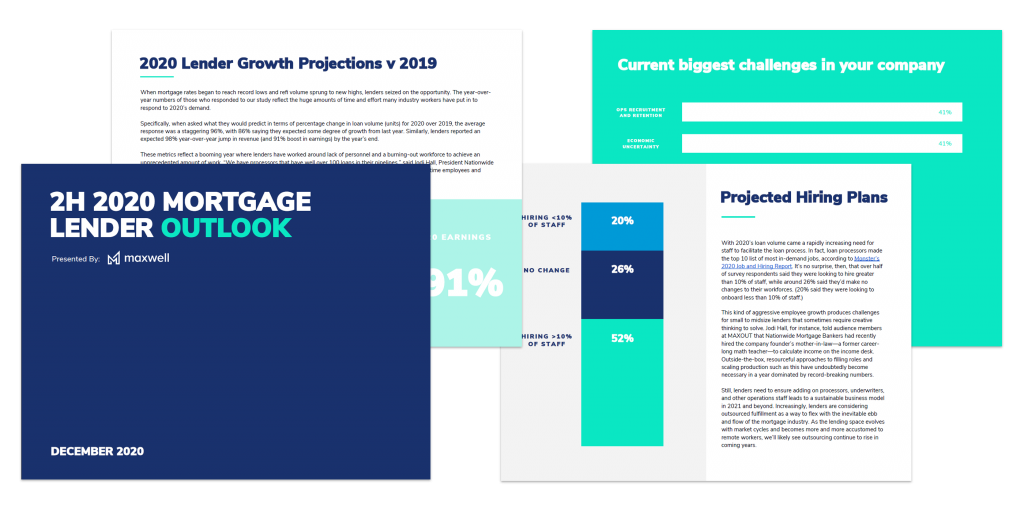

We conducted this survey in Q3 of this year, more than six months into the pandemic, to gauge lenders’ perceptions of the current market and their outlook on 2021. For obvious reasons, 2020 is an interesting year to gather mortgage industry sentiment. Not only is loan origination volume likely to reach a record-breaking $3.9 trillion, boosted by $2.4 trillion in refis, but 2021 is also expected to bring its own impressive numbers. Specifically, economists anticipate the purchase market to reach an all-time high after refis begin to dry up mid-year.

The historic nature of lending in 2020 makes it the perfect time to get a pulse on this industry. From perspectives on this year’s market and sentiment towards 2021 to hiring plans and the roadblocks that have caused most pain this year, our 2H 2020 Mortgage Lender Outlook is designed to give readers a snapshot of how mortgage workers feel at this extraordinary moment in time. Thanks to the lenders who completed our study, we’re able to provide you insight into the struggles and accomplishments of industry professionals who are just now wrapping up a year that will go down in the books as being like no other.