3 Mortgage Market Predictions Backed by Maxwell Data

Maxwell’s recently published Q4 2023 Mortgage Lending Report revealed compelling data about the mortgage market: In the last quarter of the year, borrowers navigated challenging conditions, outside-the-box loan offerings like HELOCs remained in demand—and in a striking reversal of a years-long trend, Q4 2023’s loan volume was up year-over-year.

What lies ahead in 2024? We asked the mortgage experts at Maxwell to weigh in on what Q4’s data can tell us about the current market, including how trends seen in Q4 2023 should impact lender strategy moving forward.

1. The market is headed for recovery.

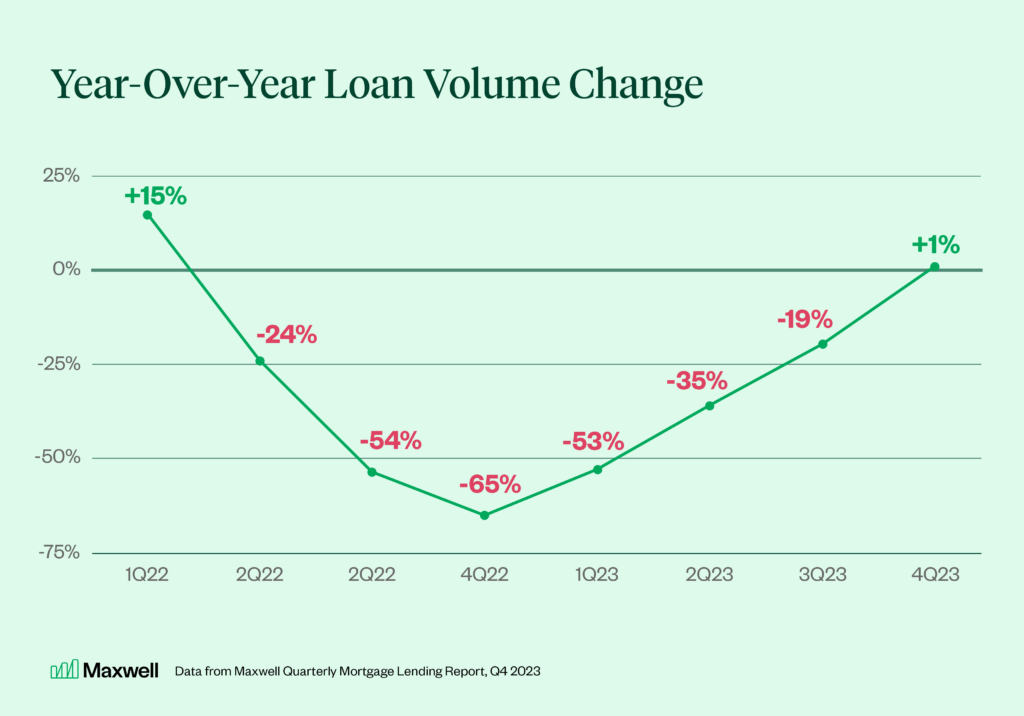

Q4 2023 brought elevated interest rates and challenging home buying conditions. Still, Maxwell data reveals the beginnings of recovery, with loan volume showing year-over-year gains for the first time in the current market cycle. This reversal is significant, signaling a glimmer of hope that we’ll see growth going into 2024’s spring selling season.

“As we enter 2024, the mortgage industry is collectively wondering whether this year will bring a major market recovery,” says Alan Parris, Managing Director of Maxwell Private Label Origination. “The data we’re seeing is telling us yes—we’re showing early signs of growth. What recovery looks like is less simple: This year will likely feature periods of fluctuation. The lenders who succeed will be those who build resilience into their businesses, embracing strategic partnerships, outsourced services, and a variable cost model.”

2. Buyers will require education and support to achieve homeownership.

The average monthly income of home buyers has jumped nearly 30% over the past three years, with December 2023 featuring a record high seen in our data ($12,100). Similarly, average loan amounts have steadily risen to now average nearly $350,000. In response, borrowers in younger age brackets lost traction in Q4, edged out of the market by lack of affordability.

If home prices and lending costs moderate in 2024, significant demand could flow into the market. That demand may still be impeded by low inventory, but lenders should still ready their businesses to capture available loan volume. Particularly, lenders who take on a relationship-forward, consultative approach with borrowers in need of support will be most likely to find success.

“In 2024, borrower support and experience will be major differentiators to lender success,” says Robert Ross, Maxwell Head of National Sales. “While it’s tempting to focus solely on driving loan volume right now, leading with a sales-heavy strategy won’t bring long term success. Rather, lenders should invest in a borrower-focused point of sale while ensuring team members take on an advisory role, guiding their customers with strong product knowledge and a people-first approach.”

3. Offering a wide array of loan products will still be a winning strategy.

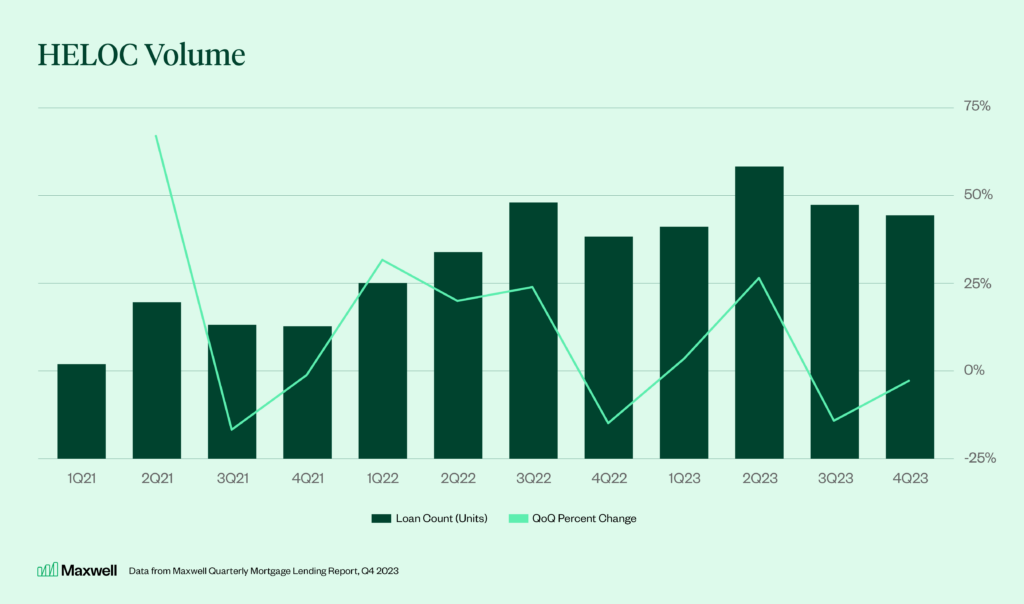

The rise of HELOCs within the current market cycle exemplifies a survival strategy employed by much of the industry: Now is the time to lean into unconventional loan products, ensuring a competitive lineup that meets the needs of a wide array of borrowers.

“This year’s market may not bring the duration or size of past refinance waves that many lenders are accustomed to during previous market recovery,” Robert comments. “In the current economic climate, rates aren’t likely to drop dramatically enough to spur a long duration refinance boom. Without a durable flood of volume, lenders need to remain protective of their bottom line, growing strategically without burdening their business with ballooning costs.”

View the full report for exclusive data on today’s mortgage market

Want to access more data to help you better prepare your lending business for the current challenges and opportunities? Maxwell’s Q4 2023 Mortgage Lending report gives insight into:

- The loan volume trends in Q4 2023 that point towards market recovery

- Numbers that illustrate the lack of affordability for today’s borrowers—and steps lenders can take to better support them to homeownership

- How loan types such as VA loans, FHA loans, and HELOCs trended in the last quarter

- The reason why all borrower age groups 44 and below declined from the previous quarter, while age groups 45 and above increased

- Steps lenders can take to get ahead of 2024’s market recovery

The Maxwell Mortgage Lending Report leverages data from Maxwell Business Intelligence, a business intelligence platform for mortgage leaders that seamlessly integrates with their existing infrastructure, identifies trends in team performance, and streamlines financial reporting. Business Intelligence derives insights from more than $300 billion in loan volume transacted on the Maxwell platform across over 300 lenders.

Get your free copy of Maxwell’s 2024 Lender Playbook: 4 Tips to Drive Profitability in a Recovering Market

By submitting this form you are agreeing to our Privacy Pledge and Terms of Use. At Maxwell, we’re committed to your privacy. You may unsubscribe at any time.