The Top 3 Market Trends Impacting Today’s Borrowers

As a seasoned lender, you know the reality of the market all too well: Changing interest rates and housing market conditions mean constantly fluctuating loan volume. Add ever-increasing competition to the mix, and it’s easy to see why capturing borrower business and impressing those borrowers with a best-in-class process are vital to long-term success.

Today’s borrower landscape—and the expectations those borrowers bring to market—look far different than a generation ago. Within this shifting landscape, a few key trends directly impact the way lenders need to think about lead generation.

1. Millennial & Gen Z home buyer dominance

The news that millennials (and increasingly Gen Zs) are shaping home-buying trends isn’t new. After all, millennials made up 67% of first-time home purchase applications last year, according to the CoreLogic Loan Application Database. Still, many lenders haven’t reworked their processes dramatically enough to appeal to these audiences.

As digital natives, millennials and Gen Zs view a modern, digital, mobile-friendly mortgage process as table stakes. Still, these demographics lack fluency with the mortgage process and crave personalized guidance. In other words, Millennials and Gen Zs challenge lenders to offer both a technology-forward mortgage process and a lending experience complemented by human-led support.

How Maxwell caters to millennials & Gen Zs

With digital functionality that delivers a fast experience augmented by human-led support, Maxwell Point of Sale creates an intuitive yet personal lending process for modern borrowers.

End-to-end digital experience with native eClosing

From application to closing, Maxwell delivers a fast, seamless mortgage experience that performs just as well on a borrower’s mobile phone as it does on their desktop.

FileFetch™

Our proprietary feature helps borrowers securely import statements and PDF documents from their financial institutions quickly and accurately via a tech-forward process.

Technology with a personal feel

Maxwell Point of Sale encourages self-serve loan apps, but also assures borrowers that LOs are available to assist when necessary. For example, LOs can assist borrowers in real time with screen share functionality if they need help.

2. The rapid rise of Spanish-speaking borrowers

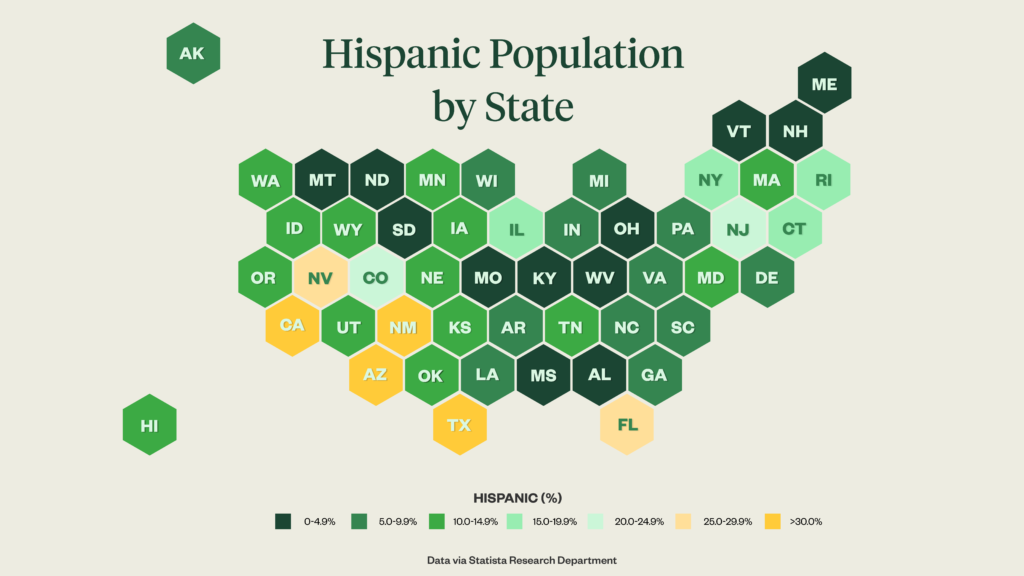

As U.S. demographics change, so does the pool of Americans pursuing homeownership. A major trend in coming years will be the rise of the Hispanic home buyer, a growing sector expected to represent 56% of all new homeowners by 2030, according to Freddie Mac. Hispanic Americans are present in significant percentages across numerous U.S. states, including California (39%), Texas (39%), and Florida (26%).

Throughout mortgage lending, Spanish-speaking borrowers desperately need processes catered to their experience. Mortgage loan applications, their terminology, and substantial documentation and information requirements pose challenges to native Spanish speakers, with limited English proficiency (LEP) one of the most significant barriers to homeownership.

How Maxwell serves Hispanic borrowers

With input from an in-house group of Hispanic American processors and underwriters, Maxwell created a Spanish-language loan experience that strengthens cultural context and retains industry-specific nuance, helping lenders attract, convert, and engage native Spanish speakers.

Spanish-language loan app

Borrowers can complete the entire loan application in Spanish without subtitles or translators, and the resulting loan file still meets all language and information requirements in the LOS.

3. Widespread borrower confusion & dissatisfaction

Today’s borrowers increasingly expect a fast, intuitive experience they can facilitate on their phone. The unfortunate reality? Lenders aren’t delivering on those expectations. Only around half of borrowers (52% of non-bank customers and 42% of bank customers) report being satisfied with the lending process, according to a McKinsey survey of 1,200 mortgage customers.

In many ways, it’s no wonder—it currently takes nearly 50 days to close on a loan, according to ICE Mortgage Technology data. This long timeline, failure to correctly communicate, and poor customer support leads millennials and Gen Zs to call today’s mortgage process “outdated, slow, and lengthy” (35%), “overly expensive” (46%), and “confusing to understand” (33%).

How Maxwell educates & impresses borrowers

With intuitive automation and tools designed to keep borrowers notified and informed throughout the process, Maxwell delivers a mortgage experience for the modern consumer.

QuickApply™

Maxwell’s loan app achieves a completion rate over 90%. The QuickApply add-on reduces borrower workload by pre-filling the loan application to speed them through the process.

Pricing comparison

QuickPricer Compare & Share allows LOs working on borrower leads to quickly create and share multiple pricing scenarios, educating the borrower and driving them to the loan application.

Want to learn more about how point-of-sale technology can transform how you cater to borrowers?

This article is an excerpt from “5 Essential Functions of High-Performing Point-of-Sale Technology.” Download our new eBook to learn:

- The 5 major goals any best-in-class point-of-sale solution achieves

- Industry and market considerations that impact each goal

- Pain points and barriers in each area lenders need to combat

- How Maxwell Point of Sale technology tackles those obstacles, including an overview of features, impact, and customer testimonials

Get your free copy of 5 Essential Functions of High-Performing Point-of-Sale Technology

By submitting this form you are agreeing to our Privacy Pledge and Terms of Use. At Maxwell, we’re committed to your privacy. You may unsubscribe at any time.