Interview: Richey May’s Seth Sprague, CMB on How to Succeed in the Second Half of 2022

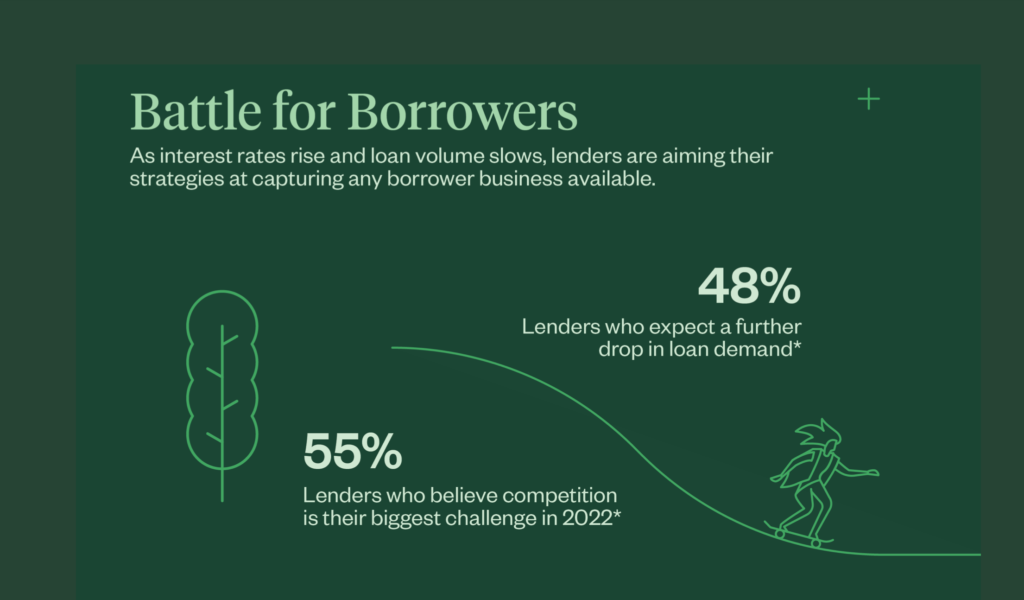

It’s no secret that the mortgage industry faces a challenging market in the remainder of 2022. The news of Fed rate hikes and inflation has impacted the mortgage market for lenders and borrowers, with loan volume declining as interest rates and mortgage costs increase.

Still, opportunity lies in a few trending factors that enhance lenders’ ability to compete even as obstacles rise. Namely, historically high levels of home equity, continued home-buying demand from millennials and Gen Zs, and innovative technology solutions that boost efficiency all provide paths to profitability if leveraged wisely. As the industry outlook changes for the six months ahead, lenders must adapt their strategy and priorities to take advantage of these headwinds if they hope to survive and compete for shrinking volume.

To get a better idea about what these challenges and opportunities mean and how lenders can navigate them, we asked Richey May’s Seth Sprague, CMB for his advice. Here’s what we learned.

This interview series is excerpted from our 2H 2022 Outlook: Managing Rising Rates, Declining Volume & the Possible Recession Ahead. Click here to download the full report.

How do you view the mortgage market as we enter the second half of 2022?

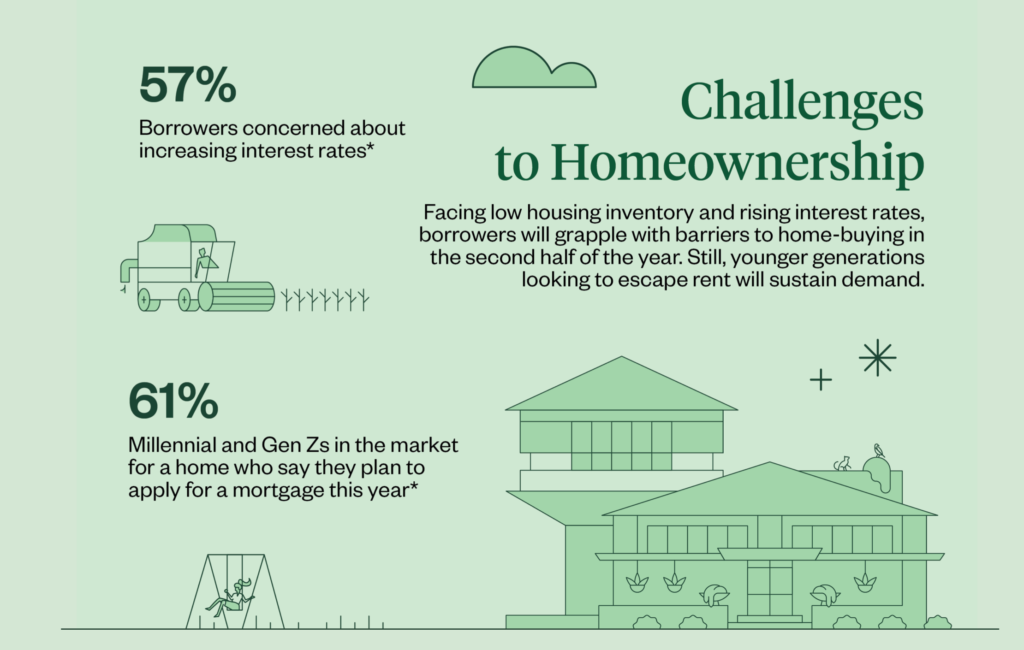

The challenges in today’s market are numerous: Average 30-year rates hover in the mid to high 5% range, housing inventory remains scarce and expensive, and origination margins are under increasing pressure. These factors not only raise immediate concerns around lender profitability, but they also call into question the path to homeownership for millions of Americans.

As we confront the market at hand and plan for the remainder of 2022, it’s vital to ensure our efforts support lender, servicer, and borrower success. That means focusing on sustainable lending methods that bolster lender profitability and control risks while setting up borrowers for long-term homeownership success.

Where should lenders focus to set themselves up for success?

On the lender side, now is the time to hone strategies and double down on the unique aspects that your business does best. During market ebbs and quick changes like we’re experiencing now, it’s helpful to go back to basics and carefully evaluate three areas of focus:

- Revenue: Lenders should get crystal clear on the metrics that impact revenue, including break-evens, margins, and volume. Carefully retest your forecasting and ask whether your current strategy supports the outcomes you’re envisioning.

- Cost: Today’s market requires lenders to make hard decisions on costs if they hope to remain viable. It’s increasingly crucial to hunker down on the expense side, closely evaluate returns on investment, and question each expense line item. For instance, if you’re still spending money on office space, does that expense continue to positively impact your company, employee experience, or borrower experience?

- Risk: As many lenders turn to new loan products and channel diversification to make up for lost volumes, risk becomes a more prevalent concern. Are changes with your staffing model viewed in a lens of risk? Do your efforts aimed at profitability support long-term business success or expose your company to undue future liabilities?

The key here is to proceed with deliberate, level-headed action based on the most current available information and data. This mindset is especially vital when it comes to the loan manufacturing process , execution in the secondary market, loan servicing, and borrower experience. Today, undue operational costs can overwhelm efficiency gains that can mean the difference between business losses and profitability.

What areas of opportunity do you see for lenders, especially within loan servicing and the secondary market?

To set themselves up for long-term success, lenders and servicers need to deeply understand the ins and outs of their business and evaluate each handoff and touchpoint carefully. A major part of this process is evaluating secondary market execution and the delivery of loans. In the current environment, with rising inflation and fears of a recession, servicing cash flows are increasingly uncertain. In response, investors tend to over-magnify that uncertainty with price decreases or price volatility and may reject products that are outside of traditional, vanilla parameters.

That sentiment makes it imperative to remain familiar with your product mix and investor demand. Evaluate each loan’s journey through your loan manufacturing process and the ultimate delivery of those loans. When it comes to the secondary market, scrutinize whether you’re pursuing the best long-term execution and whether loan delivery supports liquidity. For instance, if you’re delivering to more agencies than aggregators (or vice versa), you may want to ensure you have reviewed and or are familiar with all delivery options, including the decision to retain servicing.

How can lenders support responsible homeownership in light of 2022’s tough housing market?

When it comes to supporting borrowers in today’s challenging market, lenders need to revisit their practices around homeownership education. With inventory at all-time lows and affordability increasingly scarce, borrowers face challenges not only getting into homes but being successful in homeownership. As we’ve seen from the cautionary tale of ‘07 and ‘08, it’s a mistake to usher first-time buyers into homes with little regard for the long-term financial consequences or their ability to succeed. Lenders are faced with the reality of borrowers contending with a much higher mortgage payment, and servicers must understand the potential outcome of the current economic conditions and mortgage payments that represent a much higher percentage of a borrower’s income.

Alongside this risk mitigation, lenders should tread lightly when it comes to launching new loan products. While offerings like ARMs function differently than they did leading up to the housing crash, they still warrant caution and deliberate strategy. Similarly, fixer-upper loans and other non-traditional products may be harder than lenders realize to transact and offload on the secondary market. Here, the past is telling: Lenders who focused on their bread-and-butter, tried-and-true loan products desirable across market cycles have tended to fare best in highs and lows.

That’s not to say there isn’t opportunity in today’s market. Lenders willing to lean into their technology, especially as it relates to a modern borrower experience and highly efficient back office, will be best positioned to capture available volume in 2022. Still, the mortgage industry needs to proceed with caution: First-time borrowers with lower credit quality need to understand the repercussions of delinquencies and should be exposed to robust financial education on what it means to buy and own a house. To fail to adequately train borrowers in the quest for loan volume at any cost is a disservice to the industry in any market cycle.

Download Maxwell’s 2H 2022 Mortgage Industry Outlook

Now is the time to act on forecasts, making the proper strategy revisions to capitalize on changing market opportunities and meet business objectives for 2022.

Our newest eBook, 2H 2022 Outlook: Managing Rising Rates, Declining Volume & the Possible Recession Ahead, interviews five industry vets—Serent Capital’s Amy Brandt, Richey May’s Seth Sprague, and Maxwell leaders Bryan Traeger, Anthony Ianni, and Kim Powers—on their thoughts on the second half of 2022. The result is a forward-looking game plan to help lenders best position themselves to compete in a tightening market, available in two formats for free download: a 16-page report and an hour-long webinar recording.

Download this report—and gain access to the accompanying webinar recording—for valuable insight, including:

- How to allocate spend to bolster your bottom line

- Considerations for launching new loan channels and products like HELOCs

- Tips to hone your mortgage process to achieve peak efficiency

- Areas of opportunity that still exist in today’s challenging market

- And more!

Get your free copy of the 2H 2022 Outlook report and access the webinar recording

By submitting this form you are agreeing to our Privacy Pledge and Terms of Use. At Maxwell, we’re committed to your privacy. You may unsubscribe at any time.