Planning for 2024? Here’s How to Size Up the Market & Your Competition

When putting a plan in place for the coming year, it’s essential to understand the market landscape and the likely trajectory of inflation, rates, and inventory. From the MBA and Fannie Mae to Fitch Ratings and Goldman Sachs, numerous housing and mortgage forecasts serve as valuable resources to understand likely industry trends. Still, no one has a crystal ball—and during prolonged downturns such as we’re experiencing today, it’s wise to temper more optimistic predictions with caution, building failsafes into your business to prepare for the worst, even while hoping for the best.

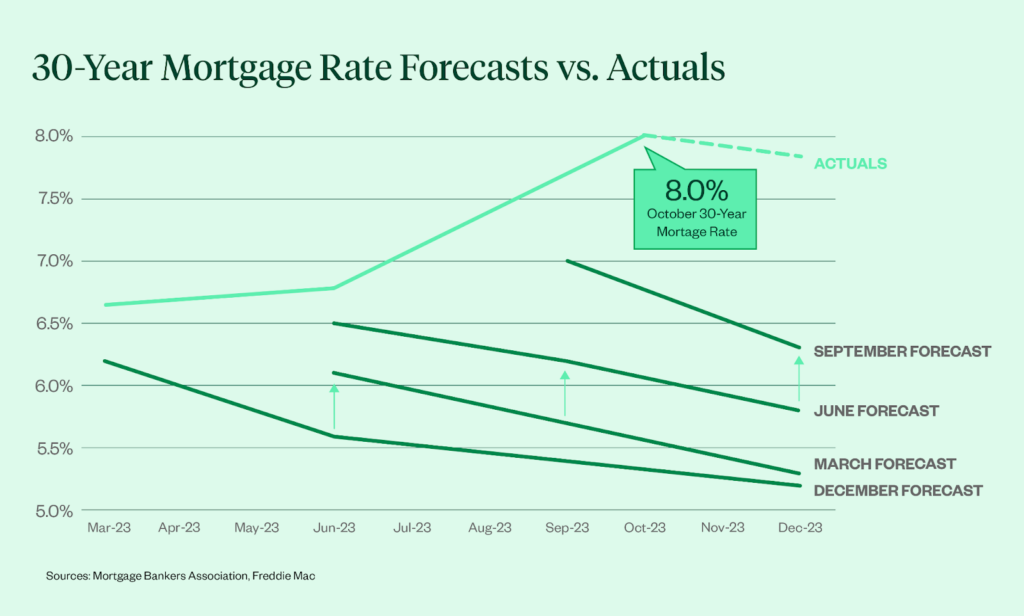

“Current forecasts for 30-year fixed rates range between low to mid-6 percent by end of 2024,” says Brian Simons, Maxwell Chief Risk Officer. “However, recent mortgage market forecasts have significantly underestimated the prolonged effects of inflation and should be taken with a grain of salt. Recent CPI numbers point to cooling inflation, but American consumers continue to show incredible resilience. We likely won’t see the Fed cut rates in the first half of 2024, and as a result, I believe mortgage rates won’t decline to the mid-6 percent range until the second half of 2024.”

Tempering optimism with a realistic view of the market

Notably, mortgage rate forecasts have missed the mark over the past two years. With ongoing inflation and geopolitical events impacting global markets, economic volatility has dominated the market cycle, creating conditions that defy both Fed rate hikes and industry predictions. For instance, in January of 2023, many mortgage economists expected rates to be around 5% by Q4, while forecasting a declining rate environment over the course of the year. As a result, lenders restructured their fixed costs but reserved capacity for a declining rate environment that never materialized.

“As we head into 2024, many economists are calling for rates to steadily decline throughout the year,” says John Paasonen, Maxwell Co-founder and CEO. “But as 2023 proved, it’s impossible to know. Lenders should proceed with a conservative mindset. The analogy is that we’re all driving down a highway with a flashing ‘Caution: Heavy fog ahead’ sign. We have to keep moving forward; however, when visibility is so low, it’s a good idea to drive differently. Today, we don’t have the consistent economic indicators to tell us when that fog might let up.”

Sizing up your competitors’ strategies

As the industry continues to slog through more than two years of trying conditions, many lenders are grasping for remaining opportunities as origination volume languishes. In this quest, it’s vital to evaluate not only the market, but also the competitive landscape to understand which routes will prove successful in the coming year. Introducing loan products, for example, is a solid, viable route to recouping lost volume, but lenders should proceed thoughtfully, leveraging the advice of trusted partners before taking action.

“Taking into account the current market conditions, I’d advise lenders to be mindful when making major business changes,” says Bryan Traeger, Maxwell Managing Director of Corporate Development. “As you look at launching new products, for instance, work with an advisor to perform a competitive analysis. By studying what others are offering, you’ll be able to understand how many loans per month you’ll be able to achieve by launching a certain offering—and from there, you’ll be able to discern whether that strategy is worthwhile.”

2024 will undoubtedly require deliberate business changes for lenders to stay ahead of the market. The key to ensuring success is to lean on providers with extensive industry expertise to understand how fast-changing market and competitive headwinds will impact various strategic moves.

“Now is the time to use every resource at your disposal to understand your best path forward for 2024,” says Bryan. “Call your warehouse lines and set up meetings with all of your trusted providers. Here at Maxwell, we’re constantly studying rate paths and fluctuations in demand for various loan products. We’re here to help our clients shape a personalized plan most likely to support profitability in 2024 given our best understanding of the market’s trajectory.”

Use our new guide to inform your 2024 plan

Want to get ahead of your competition as the market resets? Our new guide offers insight into:

- The most likely path for rates and inventory next year and beyond

- The competitive and market analyses that should shape your business plan

- Actionable strategies to bulk up your pipeline in the coming year

- Why reevaluating your cost structure is vital to achieving profitability

- How the secondary market can offer opportunities for improved financial performance

Download your copy to position your lending business for success in 2024 and beyond.

Get your free copy of Maxwell’s 2024 Lender Playbook: 4 Tips to Drive Profitability in a Recovering Market

By submitting this form you are agreeing to our Privacy Pledge and Terms of Use. At Maxwell, we’re committed to your privacy. You may unsubscribe at any time.