ebook

Maxwell 2023 Hispanic American Borrower Report

U.S. demographics have changed dramatically over the past few decades, altering the profile of American mortgage borrowers. Increasingly, today’s homebuyers are diverse, with native Spanish speakers growing in presence nationwide. According to Freddie Mac, the Hispanic American homebuyer segment has increased by 25% in the last decade. By 2030, this growing sector will represent an estimated 56% of all new homeowners.

Despite their growing numbers, Spanish-speaking borrowers often don’t find the home-buying process easy or accessible. To help lenders better serve this demographic, we recently conducted a study of Spanish-speaking borrowers, surveying over 1,100 first-time Hispanic American home buyers across the U.S. who completed the mortgage process in the past six months.

In this report, you’ll learn actionable datapoints, such as:

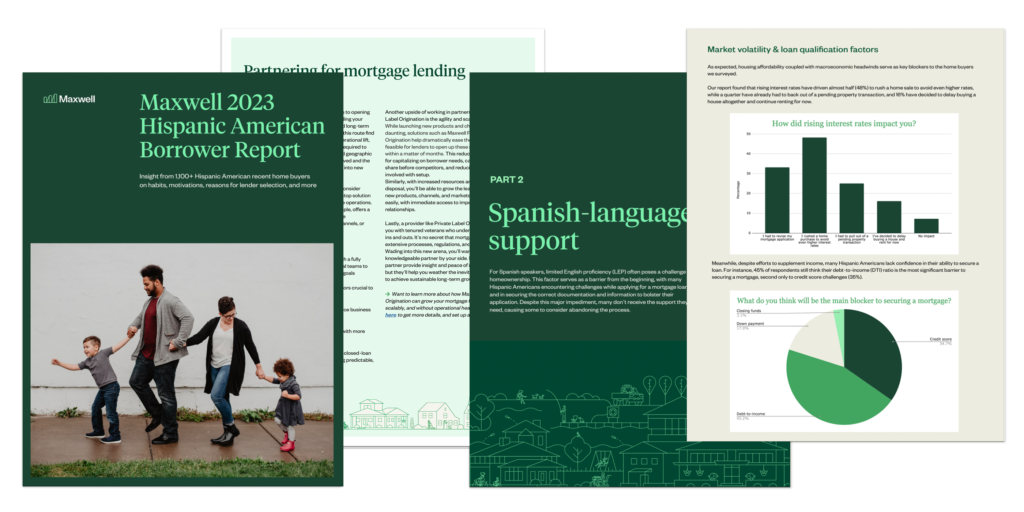

- Hispanic Americans in the market for a home tend to be highly motivated, with 43% taking on an extra job to save for a deposit.

- Despite the continued housing and mortgage market volatility, they actively seek homeownership, with the pressure to build generational wealth the driving force for 81% of respondents.

- Many aren’t getting the support they need from lenders to feel confident during home-buying, with a quarter (23%) saying language acted as an impediment in the mortgage process.

- They represent a major opportunity for those willing to connect with them, with 96% planning to choose a national or local lender in lieu of an online-based option.

Get your free copy of the Maxwell 2023 Hispanic American Borrower Report

By submitting this form you are agreeing to our Privacy Pledge and Terms of Use. At Maxwell, we’re committed to your privacy. You may unsubscribe at any time.

eBook Download

“Understanding the habits, motivations, and obstacles of this demographic will become increasingly necessary to stay relevant within today’s changing borrower landscape.”