Introducing Maxwell Processor Edge: Fulfillment Workflow Technology Built for Processor Efficiency

As the year comes to a close and the mortgage industry looks towards 2022, lenders may be wondering how to offset rising loan costs and increasing margin compression. Today’s changing market makes profitability a challenge for local lenders—and that’s why we’re excited to introduce a new solution that adds efficiency and reduces costs in the loan fulfillment process.

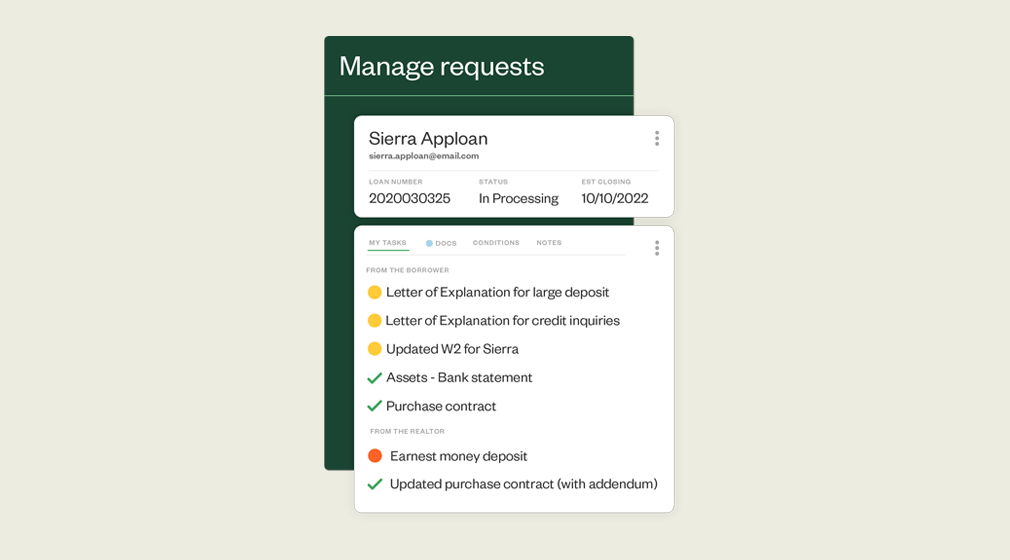

Maxwell Processor Edge, the latest addition to our Mortgage Optimization Platform, is a first-of-its-kind fulfillment workflow platform that integrates with your loan origination system. Using machine learning, Processor Edge accelerates the document review process, detects data discrepancies before underwriting, and streamlines communication with borrowers and stakeholders. Key benefits include:

- Faster time-to-close

- Fewer errors and underwriting touches per file

- Higher pipeline capacity per processor

We developed Processor Edge to help the small and midsize lenders we serve become more resilient through market cycles and in the face of increasing competition. Today more than ever, lenders need speed, accuracy, and capacity in their loan manufacturing process. Mortgage costs are on the rise, with expenses reaching a near-record high of more than $8,600 in 2021, and manual operations, handwritten notes, and “stare and compare” work hinder mortgage processor efficiency, leaving loan files prone to errors and inaccuracies. For local lenders to compete, they need technology-powered solutions that support efficiency and reliable outcomes.

Built for peak processor efficiency

In developing this solution, we worked closely with our team of processors to understand the ins and outs of their day-to-day work, including challenges, habits, and opportunities. After hundreds of hours shadowing their tasks and soliciting their feedback, we created Processor Edge. This technology provides the functionality processing teams need to review and progress mortgage files faster and more accurately than ever before. Using Processor Edge, processors can move a file into approval in days instead of weeks, reducing the per-unit cost of a loan while lessening errors and mistakes that can result in unsellable loans.

“People will always be critical in the mortgage process—but they need to be elevated to managing risks and relationships so they can focus their time and energy on the tasks that mean the most for borrowers rather than entering and validating data,” said Matt Clarke, Chief Operating Officer of Churchill Mortgage, a customer that worked with us on our beta product. “With Processor Edge, Maxwell has created a solution that recognizes this distinction and tackles operational complexities head-on.”

Solutions that enhance the entire mortgage process

With the release of Processor Edge, our Mortgage Optimization Platform now offers an a la carte suite of solutions including point of sale, onshore contract fulfillment, fulfillment workflow technology, due diligence and QC, and secondary market trading. Throughout this suite of solutions, we continue to strive to enhance the abilities of mortgage professionals with game-changing technology that delivers measurable results—in 2022’s changing market and beyond.

Want to learn how Maxwell Processor Edge can help your processing team achieve more?