Optimal Blue

Seamless pricing integration with Optimal Blue

The ability to evaluate and compare product pricing is essential for a premium borrower experience. That’s why we’ve partnered with pricing leader Optimal Blue.

Integration Overview

An intuitive pricing experience

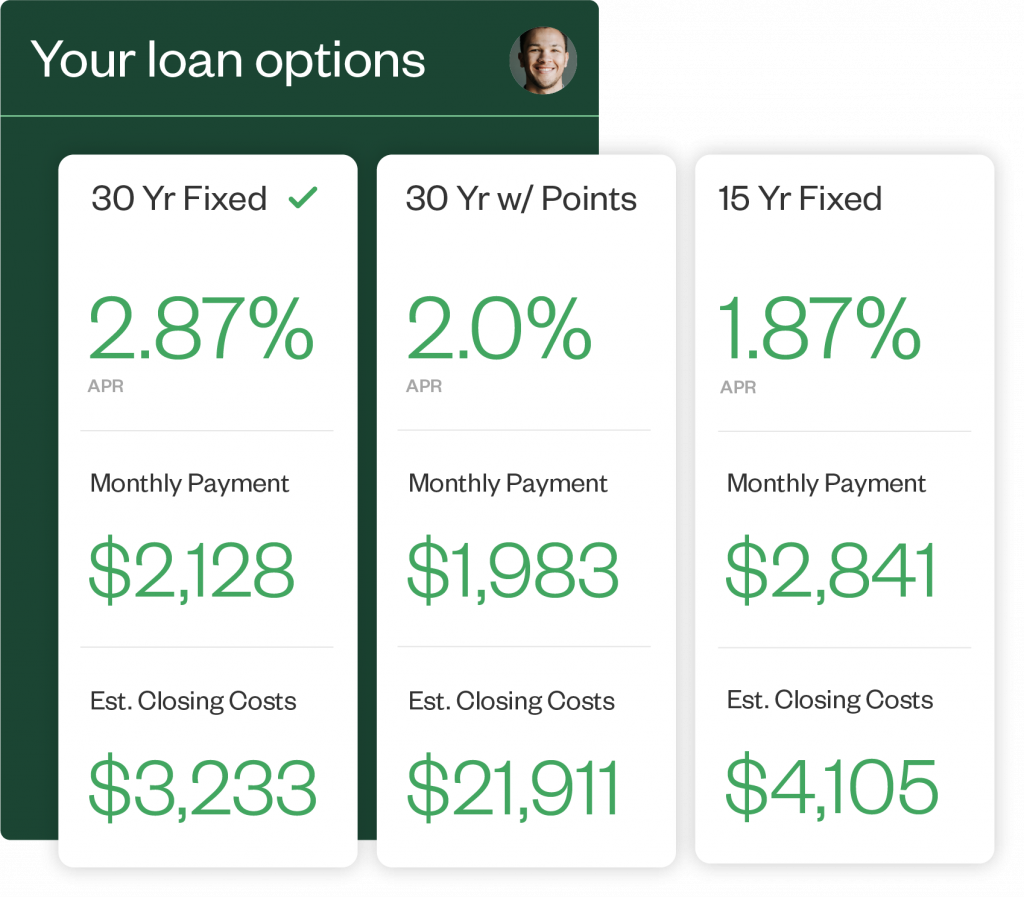

By leveraging Optimal Blue’s product eligibility and pricing API, we’re able to offer a simple, design-led pricing experience for lending teams that reduces complexity and accelerates time-to-close.

Maxwell’s integration with Optimal Blue allows for:

- Enhancement to the Encompass experience, enabling loan officers to run and save scenarios with limited borrower information

- A streamlined process for reviewing, saving, and curating the best products for borrowers

- Loan product pricing and comparison all in one easy-to-use interface

- QuickPricer Compare & Share, a powerful feature that allows loan officers working borrower leads to quickly create and send multiple pricing scenarios

About Optimal Blue

Optimal Blue, now a part of Black Knight, is a secondary market solutions and data services provider. Offering product and pricing solutions that boost efficiency, deliver comprehensive functionality, and allow lenders to remain competitive with profitable lending strategies, Optimal Blue touches one in four mortgages nationwide.

Through its robust repository, Optimal Blue is able to arm more than 160,000 users, 1,600 clients, and 160 investors with searchable and actionable loan programs and loan-level price data. A comprehensive library of APIs lends itself to automated data exchange between Optimal Blue’s digital marketplace and lender systems, resulting in more efficient lead generation, marketing, and loan origination.

To learn more about Optimal Blue, click here.