Committed to credit union success

Maxwell understands your credit union’s mission to better the financial lives of your members. Like you, we believe that a home is far more than a financial transaction—it is a place of security, comfort, and restoration. We also believe that credit unions play a vital role in the quest to extend homeownership to all Americans.

Maxwell is the only partner that provides everything credit unions need to provide members the best mortgage experience, from point of sale and business intelligence to fulfillment and the secondary market.

Maxwell partners: A commitment to credit unions

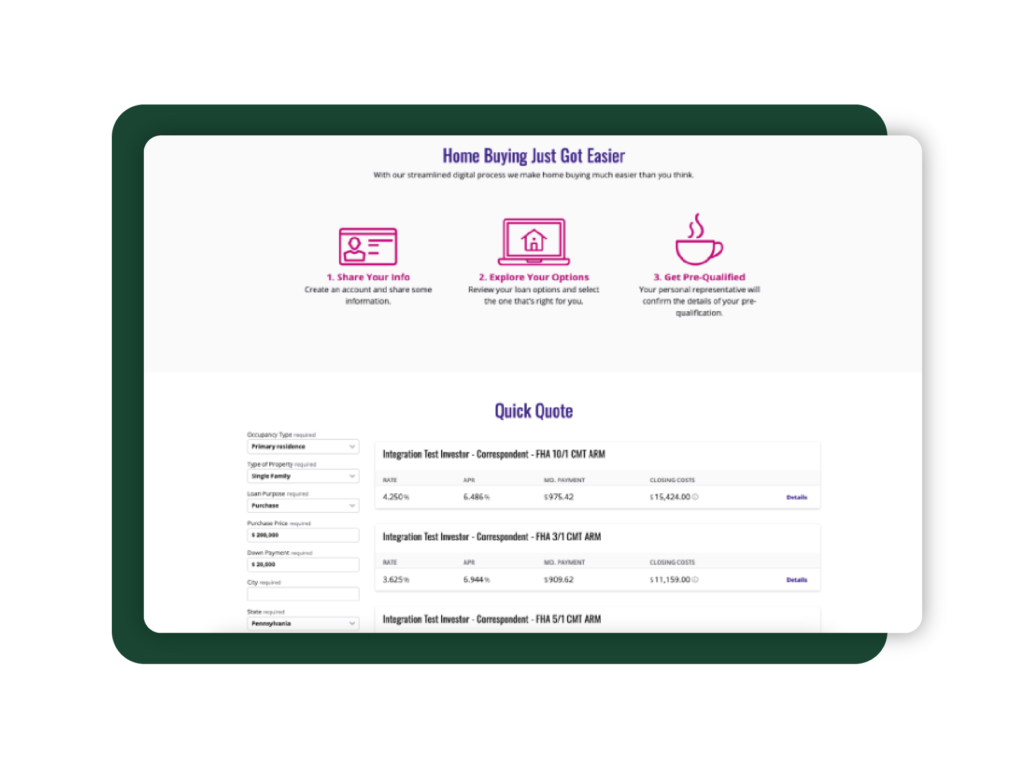

Point-of-sale technology for a top member experience

Maxwell Point of Sale was built to reduce costs, allowing you to give more back to your members. Built-in, flexible editors allow for unique workflows tailored to the unique needs of your business.

Data-driven decisions with business intelligence

Maxwell Business Intelligence features turnkey reports to provide credit unions the insight to maximize back-office efficiency, optimize resources, improve forecasting, compare to industry trends and more.

Maximum mortgage loan volume without fixed expenses

Maxwell Fulfillment provides fully onshore and experienced processing, underwriting, and closing talent. Credit unions can access top talent without high overhead costs, allowing them to reinvent their cost and resource structure and trickle those savings down to members.

Modern quality control and due diligence

Maxwell Diligence is a powerful, future-looking solution for due diligence and QC. By leveraging the latest technology, industry experience, and data guarantees, Maxwell Diligence reduces risk and errors, while increasing transparency and quality.

Better secondary market access

Maxwell Capital offers competitive secondary market pricing and full-service fulfillment support through both wholesale and mini-correspondent offerings. By increasing capacity and reducing fixed costs, credit unions maximize their return on every loan, giving more back to members in the process.

Run and scale a mortgage business with one end-to-end solution

Looking to add mortgage lending or expand your current mortgage offering? Maxwell Private Label Origination provides the technology, people, process, and systems you need to deliver a borrower-focused and variable cost-based mortgage business, so you can generate profit on every loan, regardless of volume.