7 Ways to Improve Your Borrower Experience for Profitable Growth & Competitive Differentiation

It goes without saying that happy borrowers are profitable borrowers. In a tough market, though, customer satisfaction might not always feel like top priority. The value of customer satisfaction is often hard to measure, and many a customer satisfaction initiative has failed because it was built upon a flawed understanding of customer profitability.

But lackluster customer satisfaction—and an inaccurate understanding of customer profitability—can have costly consequences.

Global consulting firm Mckinsey surveyed 27,000 American consumers across 14 industries and found that improving the customer journey can not only increase customer satisfaction by 20%, but can lift revenue by up to 15% while lowering the cost of serving customers by as much as 20%. On the flip side, a totally dissatisfied customer decreases revenue at a rate equal to 1.8x what a totally satisfied customer contributes to your business.

An improved borrower experience delivers considerable benefits to lenders. Satisfied customers across all industries spend more, demonstrate deeper loyalty, and create conditions that lower costs for the company and boost employee engagement.

The good news is that customer satisfaction improvements can be a very effective way to shore up your bottom line with only a modest investment. Furthermore, employees tend to be more open to change during a market downturn, so it’s actually the perfect time to both boost your revenue and poise your company for continued growth as the market improves.

Improving the borrower experience isn’t easy, but the payoff is significant. Mckinsey data shows that customer experience improvements build customer loyalty, make employees happier, achieve revenue gains of 5 to 10%, and reduce cost by 15 to 25% within two or three years.

In this lending climate, borrower experience is your inside track to edge out your competition. Read on for best practices for developing a successful borrower experience improvement strategy that will delight borrowers, boost profits, and solidify your competitive edge.

Develop a Borrower Experience Improvement Strategy that Resonates

As an industry, we can all do better at satisfying borrowers. Even best-in-class lenders have room for improvement in multiple areas. The best way to begin your revitalizing your borrower journey is by asking not just, “Where should we focus our efforts”, but “Where should we focus our efforts first?”

As you examine your borrower experience for areas to improve, there are a few things to keep in mind to ensure your efforts are successful for happier borrowers and a more profitable lending organization.

1.) Don’t Assume You Know What Will Improve Borrower Satisfaction

Positive ROI on borrower satisfaction initiatives requires you to take the time to thoroughly understand what drives value for borrowers.

Consumer behavior and satisfaction can seem like more of an art than a science; what you think will make your borrowers happier might not actually drive improved satisfaction.

Take an example from the aviation industry: one airport case study found that, contrary to management’s assumptions, customer satisfaction actually had more to do with the behavior of security personnel that with the time travelers spent in the security line.

We all know what they say about assumptions, and the adage holds true for lenders. Borrower satisfaction initiatives based on assumptions or gut feelings about what will make borrowers happy are bound to fail.

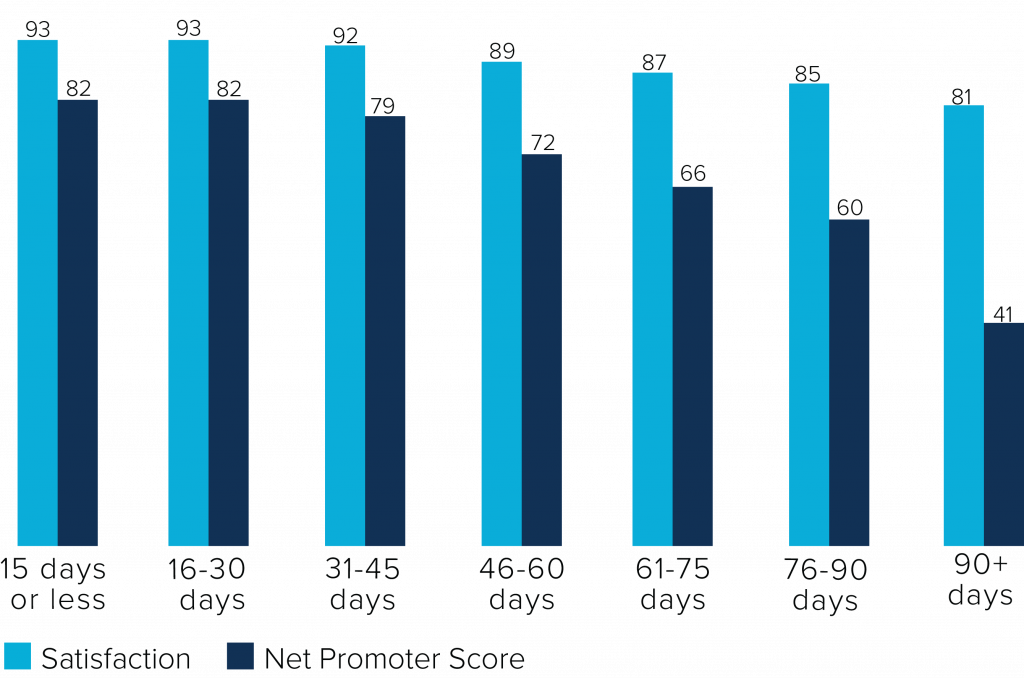

For example, it might seem like the quickest way to amplify borrower satisfaction is to double down on reducing time-to-close, but National Benchmark data shows that there are diminishing returns related to cycle time.

STRATMOR Group looked at 100k+ borrower responses and found that getting the time-to-close under 15 days is nowhere near as valuable as getting it below 30 days. If you’re already closing loans under 30 days, then time-to-close improvements will not yield noticeable improvements in borrower satisfaction, and it’s a waste of time and money to focus your efforts here.

Borrower Satisfaction by Time-to-Close

To figure out the most impactful ways to satisfy your borrowers, you have to ask them.

2.) Bring Borrowers into the Equation Early

Your borrower satisfaction improvements can only be impactful if you let feedback from current and former customers guide your strategy.

Use borrower satisfaction metrics, like Net Promoter Score (NPS), as a jumping off point. Dig into your extremely high and extremely low scores, reaching out to those borrowers to understand what went really well (or really poorly) in their experience with your brand.

And while NPS is a great place to start, it shouldn’t be your entire benchmark.

Here are a few ways to gather more detailed, specific feedback from your borrowers:

- Online focus groups with a carefully selected target audience

- Customer panels or events

- Mobile flash surveys

- Customer-experience software that integrates input from text messages, website input, and email surveys

- Small pilot programs to test early borrower experience improvements

Gathering borrower feedback is often the most difficult task in the process. The mortgage process is fraught with negative emotions and anxieties, and hearing about the emotional journeys of your borrowers might make you uncomfortable. But the best borrower feedback is that which is tough to hear, as it clearly highlights the most immediate focus areas that can be improved upon.

3.) Focus on the Journey, not the Touches

Customer journeys are made up of an amalgamation of touchpoints that coalesce into a singular experience. When it comes to customer experience improvements, companies often get too focused on individual pit stops along the borrower journey rather than thinking about the consistent quality of the trip in its totality.

Research shows that customer journeys — the end-to-end experience of buying a product or service — are a more accurate predictor of overall satisfaction than satisfaction metrics tied to individual touchpoints. In fact, end-to-end customer satisfaction metrics actually predict overall satisfaction and willingness to recommend twice as accurately as touchpoints do.

As you re-imagine the borrower experience, every decision you make from this point on should start with the question, “how does this impact the borrower journey?”

A Journey Redesign Done Right

A large bank decided to redesign the customer journey for opening new accounts. They looked at the process as a whole and reimagined how it could be done more seamlessly. Starting from square one, they redeisgned the process, eliminating 15 process steps along the way (including signficant paperwork), introduced passport and facial recognition software for instant identity verification, and established an entirely new online and mobile self-service journey for opening new accounts. The effort boosted self-service sales from zero to more than a third of total sales, with 50 percent higher conversion rates and reduced cycle times from two to six days to just ten minutes.

With customer feedback and analytics in place, you can begin to reshape the borrower experience, working step-by-step through the borrower journey to smooth out kinks, reduce friction throughout the process, and identify areas where you can improve the borrower experience for a consistently delightful journey from loan app to close. As you re-imagine the borrower experience, every decision you make from this point on should start with the question, “how does this impact the borrower experience?”

- How to improve the borrower experience? Start by asking yourself:

- How do I better control the borrower experience?

- Are my borrower communications consistent and compliant?

- Do I have controls in place over borrower communication templates?

- How flexible and scalable is my technology when defaults increase, portfolio sizes grow, or new regulatory requirements need to be implemented?

- How do I manage, resolve, and most importantly, prevent borrower complaints?

- How do I make the loss-mitigation process more efficient?

4.) Make digital technology a cornerstone of your improvement strategy

In January 2019, STRATMOR Group released a study that highlighted the new digital status quo in lending. The report found that 76% of mortgage lenders now give borrowers the ability to sign disclosures online compared to 61% in 2017, while 72% allowed borrowers to upload documents and respond to loan conditions online.

The report indicates a shift in both focus and investment dollars from regulatory concerns to improving the borrower experience. Many lenders are managing the burden of regulatory compliance with outside assistance; 72% of respondents reportedly rely on agency solutions for loan delivery data validation, compliance, and loan salability, thereby clearing up headspace to focus on borrower satisfaction.

“Today we have an environment that is about stealing market share and succeeding with the tougher purchase transactions. Customer satisfaction and maintaining relationships have replaced regulatory mandates as the top concerns. That means meeting the needs of borrowers and referral sources. Today’s borrowers expect a digital experience, and lenders that do not empower consumers to upload and execute loan documents online are not only in the minority but are falling far behind their peers.” — Garth Graham, Senior Partner, STRATMOR Group

Digital mortgage technology alone isn’t enough to improve the borrower experience.Digital solutions need to be integrated throughout your entire origination process, infused throughout your operating model, and woven into the very fabric of your culture. From there, you’re ready to redesign the borrower journey from start to finish, using digital elements as the foundation to create a better journey for borrowers.

5.) Tie Borrower Satisfaction Metrics to Operational KPIs

A reliable customer satisfaction initiative starts with analyzing customer profitability to understand not just what customers are profitable, but why some are more or less profitable than others. Before implementing any customer satisfaction initiatives in place, it’s imperative to thoroughly understand your customer profitability metrics to pinpoint the borrower behaviors that create the most value for your company so you can then invest in tools and processes to perpetuate those behaviors

The key to delighting your borrowers is to go beyond measuring their satisfaction to use borrower-satisfaction metrics to drive action throughout your organization. The type of metric you use to benchmark borrower satisfaction isn’t as important; what matters is how it’s applied.

For example, link NPS promoters to those who complete a refinance within two years after their first mortgage. Or, look at the cost to serve promoters compared to the cost to serve detractors and neutrals. Does one group close faster than another on average? Are there less underwriting touches in each group? How does their revenue compare? Now, what would happen to profitability if 10% of neutral borrowers moved to promoters, and 10% of detractors became neutral?

Global consulting firm Bain conducted in-depth research of affluent banking customers and found significant differences between the profitability of promoters, passives, and detractors. They discovered that promoters gave their primary bank almost 45% more of their household deposit balances than detractors do.

Promoters bought more products from the bank, and their product selection skewed to more profitable products. What’s more, attrition rates were substantially lower for promoters and the promoters made nearly seven times as many positive referral as detractors.

What’s shocking is the economic outcome of their study: they found that the promoter was worth roughly $9,500 more to a bank than a detractor.

In fact, detractors actually destroyed value over the customer lifetime! Identify those value metrics with the largest differentiations between detractors and promoters as a strong hypotheses to deliver the ROI you’re seeking as you improve borrower satisfaction.

It’s imperative to build an explicit link to value creation by elucidating how satisfied borrowers influence profitability in your organization. Analyze historical performance of satisfied and dissatisfied borrowers, and pinpoint the borrower satisfaction issues that will yield the highest payouts.

The most profitable customer-experience leaders put the customer journey at the center of their strategy and connect other operational KPIs out from there.

Once you’ve figured out your most crucial metric to measure borrower satisfaction in your organization, make that your top priority and then cascade downward with metrics to measure performance indicators at touchpoints along the borrower journey, utilizing employee feedback to identify opportunities for improvement along the way.

6.) Find a good balance between short- and long-term wins

An effective re-tooling of the borrower experience is a journey in and of itself, one that can (and should) look out into the next two to four years.

“In order to rewire a company to become a customer-experience leader — for most companies this will be a two-to-three-to-four-year journey. The reason it takes so long is quite frequently, you need to work across functions, geographies, and customer segments, and it just takes a while. You need to start where you can show impact quickly before you can scale. Once you succeed, though, you’ll have a competitive differentiator that others will find hard to match.” — Ewan Duncan, Senior Partner, Mckinsey

While your strategy should include some positive-ROI quick wins (more on how to find the quick wins later), a truly exceptional borrower experience transformation requires a long-term commitment.

The most successful customer experience transformations take a balanced approach, tackling a mix of short-term initiatives that pay off quickly and sustain momentum to support the longer-term initiatives that take time to deliver results.

Prioritize borrower pain points with the highest payoff, and find the quick wins that yield a tangible benefit early on and validate your efforts. Focus on initiatives that you can control yourself and don’t require lengthy rollouts. Then focus on your long game and tackle the more complex areas that need improvement and take longer to yield results.

Here’s a great example of a successful, balanced customer satisfaction initiative feature in Mckinsey’s 2017 Customer Experience Compendium:

“One major US airport, pursuing a multiyear passenger-experience redesign, paid attention specifically to quick wins. One example was to get rid of the moving sidewalks — the customer-experience diagnostic exercise revealed that they were used primarily by employees and were not particularly important to passengers.

The maintenance and operational teams jumped at the chance to remove the moving sidewalks, which were expensive to maintain and required frequent attention. Similarly, the merchandising and retail leaders saw a potential for increased sales in having more passengers walking alongside storefronts. Removing the moving sidewalks turned out to be a quick change that eliminated costs and increased revenues, building support for the transformation and generating money for reinvestment elsewhere in the program.

What’s more, a survey of customers found that what they wanted most was not a dramatic service redesign but consistently clean bathrooms. The airport could work to over-deliver on this preference and rapidly improve customer satisfaction.

As a result of the overall portfolio of initiatives, the airport jumped from 11th to 5th place in US airport customer-experience rankings—the biggest one-year jump of any airport.”

7.) Foster a borrower-centric culture

Furthermore, borrower experience improvements should be supported by a company-wide borrower-centric mindset that cascades down from upper management and touches employees on the frontlines.

As Firuzan Iscan — Head of Customer and Distribution Experience for European financial services company Allianz SE — notes, the majority of the effort in improving the customer experience comes from instilling a customer-centric mindset in your company:

“So 90 percent [of the customer experience transformation] is about culture, and that’s why through our customer-focused projects, we want to involve more people in the organization; we want to include all stakeholders. We are asking our entities to build cross-functional teams for customer-experience projects.”

As an added bonus, a borrower-centric culture does more than just facilitate happier (more profitable) customers: it also improves employee satisfaction and retention.

In fact, companies that make a concerted effort to improve their customer experience also see employee engagement rates go up by 20% on average.

7.) Implement and track results

And now, for the best part: implementation. One approach to implementation is to create a roadmap of customer-focused initiatives, potentially segmented by customer type if you’re feeling ambitious (e.g. purchase vs.refinance, demographic segments of customers, etc).

This ensures that you avoid a slow, unclear path to impact. Sprinkle short- and long-term wins in equal measure throughout your roadmap, and include estimated implementation costs and timelines to positive ROI for each initiative. For example, solutions like Maxwell can be deployed quickly and are easily implemented with frontline teams, maximizing the time-to-value for your team. By stack ranking your initiatives by these factors, you can clarify and identify focus areas to prioritize first.

Because your borrower experience transformation strategy starts with the high-payoff, low-effort pain points, you’ll quickly see customer satisfaction scores climb.

As your initiatives begin to generate financial return, use those winnings to invest in longer-term solutions.

Conclusion

It’s not uncommon for mortgage businesses to approach borrower-focused initiatives with either unrealistic, lofty ambition or a lackluster attitude of “we just need to get it over with.” Unfortunately, both approaches often result in stalled, ineffective initiatives (or worse, die a slow, expensive death).

Instead, invest the time to build a business case that demonstrates the clear ROI of transforming your borrower experience.

73% of companies with “above average” Customer Experience maturity perform better financially than their competitors (compared to 44% of less mature companies). — Temkin Group

Not only will you see the financial windfall, but you will also get to witness your culture transform alongside your borrower experience.