Mortgage Executives

Future-proof your lending business

Technology’s impact on the mortgage industry extends beyond loan applications and document management. Maxwell’s team of technology experts and mortgage veterans partners with forward-looking lenders like you to solve market challenges and help you thrive.

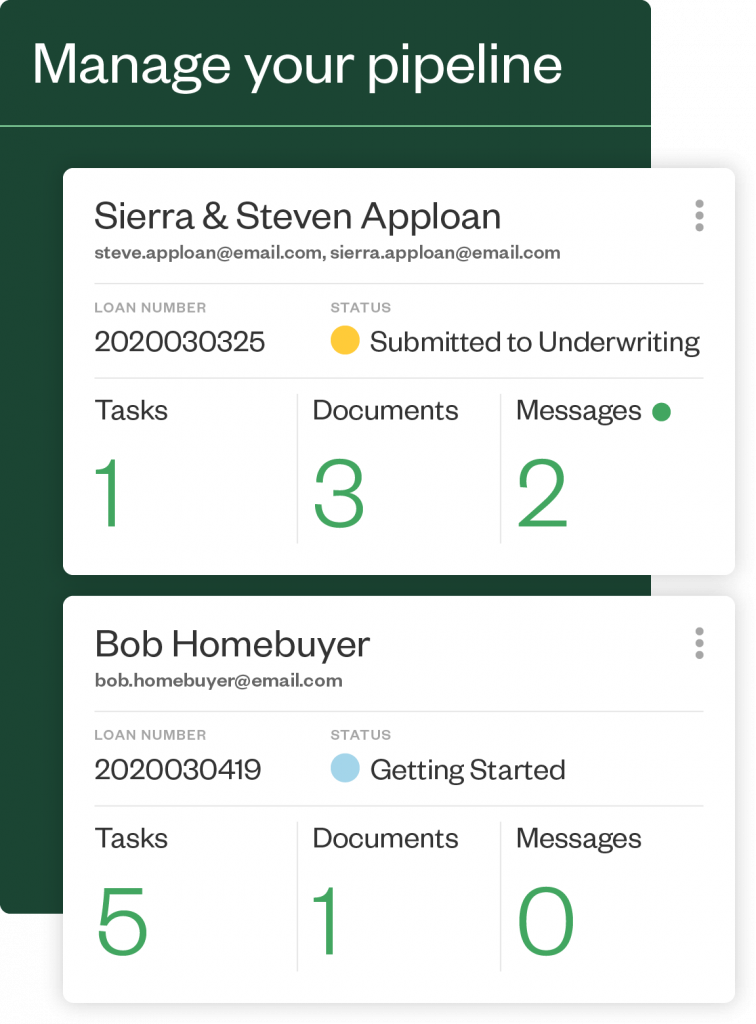

Maxwell powers all the ways you do mortgage

Maxwell’s innovative solutions are impactful on their own and transformative when used together.

Maxwell is dedicated to America’s local lenders

Our mission at Maxwell is to give America’s local lenders a permanent, disruptive financial advantage. That means credit unions, community banks, and independent mortgage banks can compete and win against the largest and most technology-advanced lenders. We do this by addressing the toughest bottlenecks in the loan origination process, empowering your people with the latest technology and adding real basis points to your bottom line.

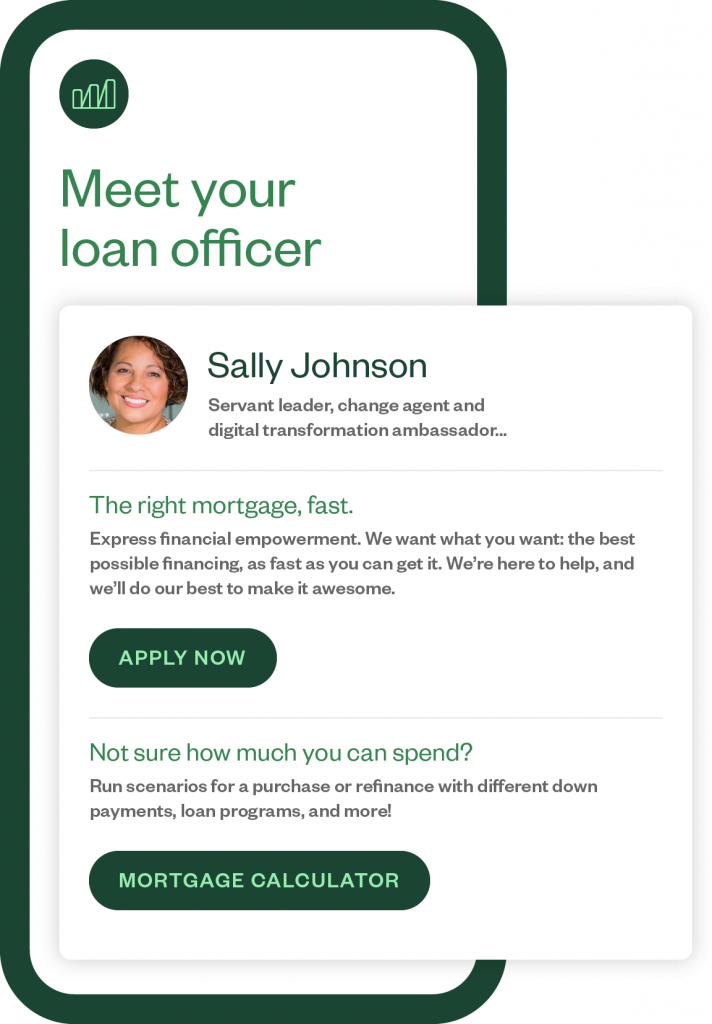

Attract and retain talented LOs

When you use any or all of Maxwell’s solutions, you give your loan officers the power to close more loans, increase referrals, and earn more money—making your business the place where top producers want to work.

15% more loans closed per month by LOs on Maxwell

Streamline your cycle time

Intelligent automation, thoughtful integrations, and an uplifting user experience shaves over 10 days off the average time to close a loan.

13+ days saved from application to clear to close

Change your cost structure

With Maxwell Fulfillment, lenders of all sizes shift more costs into a per-loan expense, removing recruiting and overhead costs and preparing their business to thrive through every economic cycle. Maxwell technology powers our team of 100% US-based, vetted, and experienced processing, underwriting, closing, and QC talent who deliver a five-star experience for lenders and borrowers.