South Carolina leads the nation in net borrower migration: Uncover essential insights for mortgage lenders

In this exclusive report we use Maxwell Business Intelligence to unpack migration trends in the state of South Carolina. With the 5th highest growth compared to any other state, South Carolina provides opportunities for mortgage lenders to consider as they look to grow their mortgage footprints.

South Carolina takes the #5 spot in highest inbound migration across the US

In this report, you’ll discover how to reach borrowers migrating to South Carolina with our exclusive insights, including:

- South Carolina’s growth compared to other states

- The top states people are migrating from

- Hotspots where people in South Carolina are settling, including city – and county-specific data

South Carolina growth compared to other states

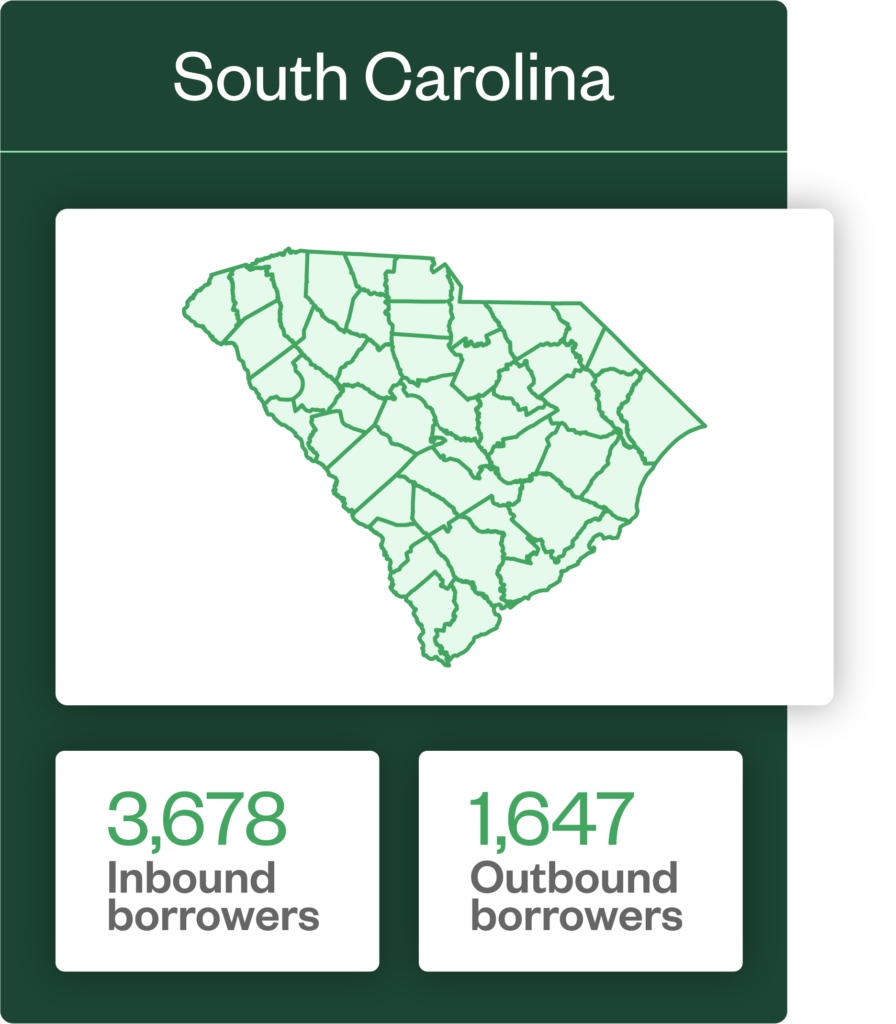

The trends presented in this report are derived from borrower migration data. The map above illustrates the net growth or decline each U.S. state has experienced due to borrower migration since 2021. The figures are calculated by subtracting the total number of outbound borrowers (those moving out of the state) from the total number of inbound borrowers (those moving into the state), then dividing by each state’s 2023 U.S. Census population. These trends indicate which states are attracting more borrowers than they’re losing, highlighting growth potential and opportunities for lenders to expand their footprints in these regions.

Maxwell Business Intelligence data reveals that over 3,600 borrowers moved to South Carolina from out of state, while around 1,600 moved out of the state since 2021. This ranks South Carolina as the fifth-highest state in net migration growth per capita.

This growth percentage considers population size so large states like California, Texas, and New York don’t skew the data. South Carolina’s positive net migration shows the relatively high number of incoming residents to the state. Ahead of South Carolina, ranks Montana, Hawaii, Arizona, and Tennessee.

South Carolina’s growth suggests the state’s growing appeal and presents an increasing opportunity for local banks, credit unions and mortgage banks to expand their customer base. As mortgage lenders seek to connect with new borrowers, it’s important to consider where these residents have relocated from.

Migration by state:

The top 5 states residents are relocating to South Carolina from

Maxwell lender data reveals that North Carolina is the primary source of new residents moving to South Carolina since 2021, with 577 borrowers making this relocation. Behind North Carolina, 286 people relocated from Georgia to South Carolina, and then New York took the third place, with 177 people moving from New York to North Carolina.

These figures underscore diverse origins of individuals and families choosing South Carolina as their new home. Understanding these migration patterns can help lenders target and attract new borrowers from these key states more effectively.

Mapping South Carolina’s migration: Where borrowers choose to settle

Maxwell’s data reveals the most popular cities and counties where new borrowers are choosing to establish their homes in South Carolina.

Top cities for inbound borrowers:

- Summerville

- Greenville

- Columbia

- Charleston

- Simpsonville

Leading counties for inbound borrowers:

- Spartanburg

- Charleston

- Anderson

- Greenville

- Horry

Lenders in South Carolina can use these locales for tailored marketing and outreach efforts. Focusing on the top cities and counties for inbound borrowers allows you to develop targeted strategies to connect with potential clients seeking out these high-demand areas.

Charting the course forward

Don’t miss out on the chance to grow your mortgage business in South Carolina. With the right insights and strategies, you can make the most of this market and secure your place as a leading lender in the state.

South Carolina’s status as the state with the fifth-highest net borrower migration offers a significant opportunity for growth. By leveraging the comprehensive analytics in our report, you can connect with more borrowers and maximize your business potential.

Request a demo

Harness the power of Maxwell Business Intelligence to enhance your organization’s data capabilities. Request a demo today and discover how our analytics can help you connect with the borrowers shaping South Carolina’s future.