Our Approach

We empower lenders to thrive

Maxwell’s on a mission to continuously innovate solutions for local lenders across America. Here’s how we’re doing it.

Our guiding principles

Expert-led

We created Maxwell only after spending over 1,000 hours speaking with mortgage professionals to understand their goals, challenges, and day-to-day pain points.

Forward-thinking

We understand the unique opportunities and hurdles lenders face and strive to anticipate solutions that future-proof your business. By applying technology to market challenges, we give you powerful tools to remain competitive even as the industry evolves.

People-focused

The lending industry works best when the people in the process are empowered by high-tech solutions. We build Maxwell technology to help your most valuable asset—your lending team—thrive.

A better lending process

Technology and innovation are changing lender operations and borrower expectations. Meanwhile, large lending institutions continue to vie for market share. For small to midsize lenders, the competitive landscape feels higher stakes than ever.

At Maxwell, we’re working towards a vision of lending efficiency and unprecedented economic scale for lenders that serve their local communities. We channel our industry knowledge to build products that add measurable improvements to your bottom line and unlock a streamlined lending process. Most importantly, we create tools with you in mind, tailored to your everyday realities and designed to help you grow.

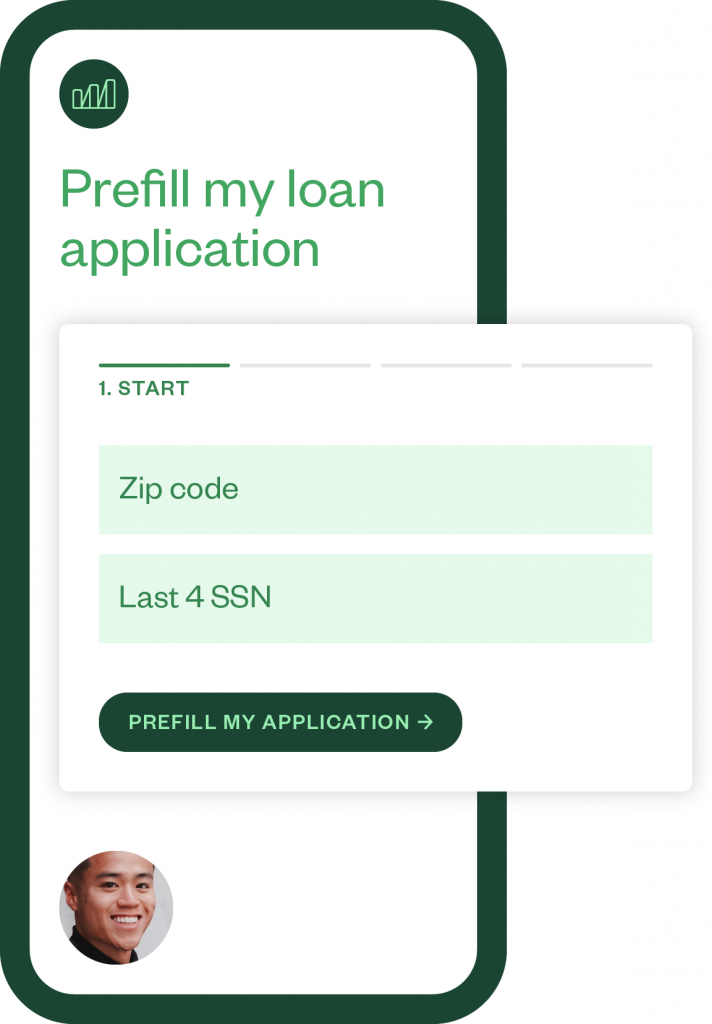

A part of meeting industry demands is ensuring an optimized process from intake of application to clear to close and beyond. Maxwell’s suite of offerings, including point of sale, loan fulfillment, and due diligence, addresses the entire loan lifecycle. Whether used separately or together, these solutions arm lenders with the tools they need to tackle the industry’s challenges of today—and tomorrow.

Maxwell Co-founder & CEO

John Paasonen

“Maxwell solutions are impactful because they enhance the entire mortgage process, giving local lenders their best possible chance to compete.”

—John Paasonen, Maxwell Co-founder & CEO

Point of sale impact

20%

More loans closed per LO

21

BPS saved in costs per loan

41%

Increase in net income

13+

Days faster to close

Trusted by hundreds of lenders in local communities

Larger circles indicate more lenders

300+

Lending institutions