“Housing Crash” Google Searches Jump by 2,450%: Why You Shouldn’t Panic

What better insight into overall human sentiment than Google search trends?

It comes as no surprise on the heels of rising interest rates, record-high home prices, and growing buyer demand that Google searches for “when is the housing market going to crash” surged by 2,450% in the first week of April over the previous year. In fact, volume for the search reached a high not seen since 2004. Other similar searches, including queries around why prices are incredibly steep and whether now is a good time to buy or sell, also saw record growth.

Across the country, a tense environment of fierce competition and an aura of unsustainability loom. But is the market really headed for a crash?

While none of us can truly predict the future of the housing market, there are a few reasons that the market today is far different than the pre-housing crisis market. So while the current environment might feel like a bubble, many experts say that headlines suggesting an eminent crash are more fear-mongering than accurate prediction.

Let’s examine some of the factors driving 2021’s market and envision some of the most likely outcomes.

A COVID-induced housing craze

Around this time last year, economists worried the housing market, along with the overall economy, was headed for a downturn. As shelter-at-home orders rolled out across the country, home-buying demand came to a halt.

Then the Fed lowered interest rates to prop up the housing market. Meanwhile, the American public, settling into work-from-home routines, began to eye suburban options to lower their living expenses and enjoy more space.

Both refinance and purchase demand began to skyrocket. Due to massive demand, home prices started to rise at their fastest rate since the Great Recession. And alongside that rising demand, home-building rose to meet it. As construction increased, so did lumber prices, a trend that further boosted home prices.

Housing inventory reached a record-low 1.03 million units by the end of February, down 29.5 percent year-over-year, according to the National Association of Realtors (NAR). The result of a frenetic market, homes began selling in an average of 20 days, down from a 60-day average.

“It gives the feel of a bubble,” said Lawrence Yun, NAR’s Chief Economist. “But the fundamental factors are different.”

Not a Great Recession bubble

Two major reasons today’s market is dissimilar to the conditions preceding the Great Recession are demand and risk.

In contrast to the sub-prime lending that caused 2008’s crash, where loose lending requirements created a housing boom, the current demand is driven by organic forces. Aside from many Americans relocating, millennials are entering the market in mass amounts as they reach peak home-buying age. In fact, the pandemic helped some millennials get into a home sooner. According to a survey by NAR, almost half of millennials (49%) pushed up their plans to buy a home due to the pandemic because telecommuting opened options for home-buying in cheaper areas.

Today’s lending practices are also far more conservative than pre-Great Recession standards. Lenders require far higher credit scores, and mortgage credit availability has plummeted to its lowest level in six years. In fact, despite slightly loosening standards, experts worry that tight requirements will keep first-time buyers and underserved demographics out of the housing market.

“Banks and mortgage lenders have been disciplined in extending credit, a very different approach than we saw in the previous housing boom,” said Danielle Hale, Realtor.com Chief Economist.

“In fact, banks have tightened underwriting requirements in the wake of lockdowns last year, so buyers today are more qualified than they’ve been in quite some time.”

A cooling, not a crash

So if we’re not looking at a traditional bubble, what can we expect out of the current market?

Experts urge borrowers and mortgage professionals not to panic. We’ll likely experience a cooling market, where demand remains healthy but rising rates cause home price growth to slow in response.

“We’re not going to see a crash in the housing market, but we are expecting some cooling on the really unsustainable growth rates that we saw, particularly in 2020,” said Robert Dietz, National Association of Home Builders Chief economist. “When home prices are growing faster than incomes, ultimately that is an unsustainable trend.”

Specifically, economists expect the market to begin to return to more normal pre-COVID trends. NAR Chief Economist Lawrence Yun predicts:

—The volume of U.S. home sales to drop 10 percent year-over-year by Q4 2021

—Mortgage rates to climb to 3.5 percent

In other words, as the market ebbs, it will mirror regular economic cycles.

Continue to prepare for strong buyer demand

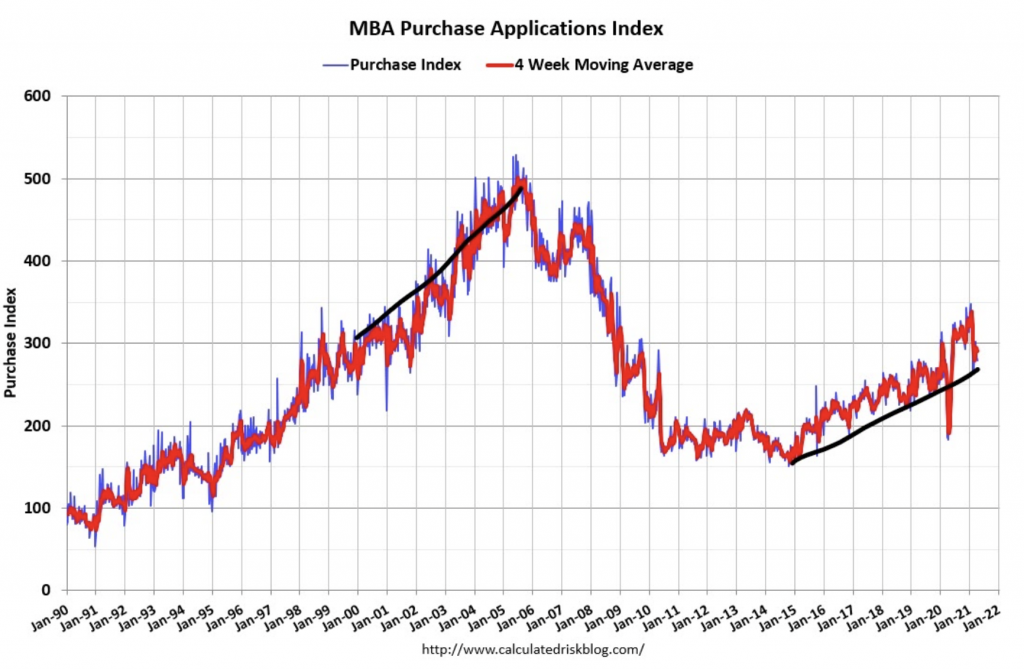

Back in January, NAR reported that the years 2020-2024 will likely have the best housing demographics ever recorded. Coupled with historically low interest rates, it’s no surprise that the market is red hot. And even despite this demand, according to the Mortgage Banker Association’s Weekly Application Survey, which measures housing and mortgage market activity, lending now looks nowhere near the same as pre-Great Recession levels.

Instead of a crash, we’ll likely see a market cooled by rising interest rates but buoyed by extremely strong buyer demand. Since so many more Americans are at home-buying ages now compared to any time in recent history, conditions may remain more stable than the Googling American public expects.

To prepare for the rest of 2021 and coming years, brush up on your millennial homebuyer marketing skills, and stay calm.

Download our free ebook “The Millennial Playbook” to prepare for the coming flood of millennial borrowers.